Report Bali Real Estate market 2025 and predictions for 2026

- Jeisti Emillia

- Dec 29, 2025

- 3 min read

As of December 2025, the Bali real estate landscape has entered a definitive phase of market normalization. Following the explosive post-pandemic "gold rush," the market is moving away from speculative hype and toward a more rational, data-driven ecosystem. While prime hotspots like Canggu face land scarcity and supply saturation, the island is seeing a strategic shift toward high-quality, sustainable developments and emerging value zones.

Market Summary 2025: The Year of Calibration

The year 2025 was defined by record-breaking tourist arrivals—surpassing 6.5 million international visitors. This has led to a more competitive rental market where design and guest experience now outweigh simple location as the primary drivers of ROI.

Occupancy Trends: Premium properties maintained strong rates of 70-80%, while "copy-paste" developments saw a slight squeeze in margins.

Price Normalization: Land prices have stabilized, allowing for valuations based on actual rental yields rather than speculative asking prices.

Predictions for 2026: The Strategic Evolution

Infrastructure-Driven Hotspots: Progress on the Bali Urban Subway and road upgrades are unlocking value in coastal regions.

The Rise of Eco-Luxury: Consumer demand is shifting toward sustainable architecture. 2026 will reward developers using natural materials and low-impact builds.

Micro-Location Precision: Success is found in "pockets" of high demand, such as Tegallalang (Ubud) and the cliff-side communities of Uluwatu.

LAND MARKET

As of late 2025, the Bali real estate market continues to show strong demand, particularly in the "hotspot" corridor of the southwest and the cultural center of Ubud.1 For your research, prices are typically quoted in IDR per are (100sqm).

Below is a market research summary of land prices for sale (Freehold/SHM) and rent (Leasehold per year) across your requested areas.

Finished Villa Price per SQM

In the Bali property market of late 2025, pricing is increasingly calculated by building size (sqm) to account for varying luxury levels, especially with the rise of high-end prefab and tropical-modern designs.

Below are the estimated prices per square meter for finished villas (inclusive of land value for sale) across your target areas.

Area Insights for Developers

1. Canggu (Berawa & Pererenan)

Sale (Freehold): A 200 sqm villa on 3 are of land typically starts at IDR 6B - 8B. High-end "designer" builds in Pererenan are pushing closer to IDR 50M/sqm.

Rent: Demand for "closed living" (AC in the living room) is at an all-time high, allowing landlords to charge a 20% premium over open-living styles.

2. Seminyak

Sale (Freehold): Prices remain the highest due to commercial "HGB" or "SHM" status and scarcity. You are often buying the location rather than the building.

Rent: Yearly rentals are frequently converted to daily "Airbnbs" because the daily yields (IDR 4M–7M/night) far outperform yearly contracts.

3. Uluwatu (Bingin & Pecatu)

Sale (Leasehold): This is the "capital of leasehold." Many investors prefer 30-year leases here to maximize ROI. A modern 150 sqm villa can be bought for IDR 3B – 4.5B on a 25-year lease.

Rent: The "digital nomad" influx has moved from Canggu to Uluwatu, keeping yearly rent prices high (approx. IDR 400M–600M/year for a 2-bedroom).

4. Ubud (Sayan & Tegallalang)

Sale (Freehold): As you've likely seen in your Tampaksiring project, prices are much more accessible. You can build/buy a high-quality villa for IDR 20M/sqm and still have a luxury finish.

Rent: Ubud has a lower "rent-to-value" ratio than Canggu but enjoys much higher occupancy in the "wellness" and "long-term retreat" niche.

5. Sanur

Sale (Freehold): Most buyers here are "lifestyle" buyers (retirees or families). Prices are stable and less volatile than the west coast.

Rent: Sanur is seeing a spike in leasehold interest because of the new International Hospital and malls, making it a "safe" long-term play.

The construction of a 2 Bedroom villa in Bali generally take 10–14 months

Annual Operating Expenses

Estimated at roughly 35% of gross revenue.

Staffing: IDR 84M (2 staff for housekeeping/pool/garden).

Management: 15% of Gross Revenue (Marketing, OTA management, bookings).

Utilities & Maintenance: IDR 75M – IDR 100M (Electricity, high-speed Wi-Fi, chemicals, general repairs).

OTA Commissions: 15% (Airbnb, Booking.com).

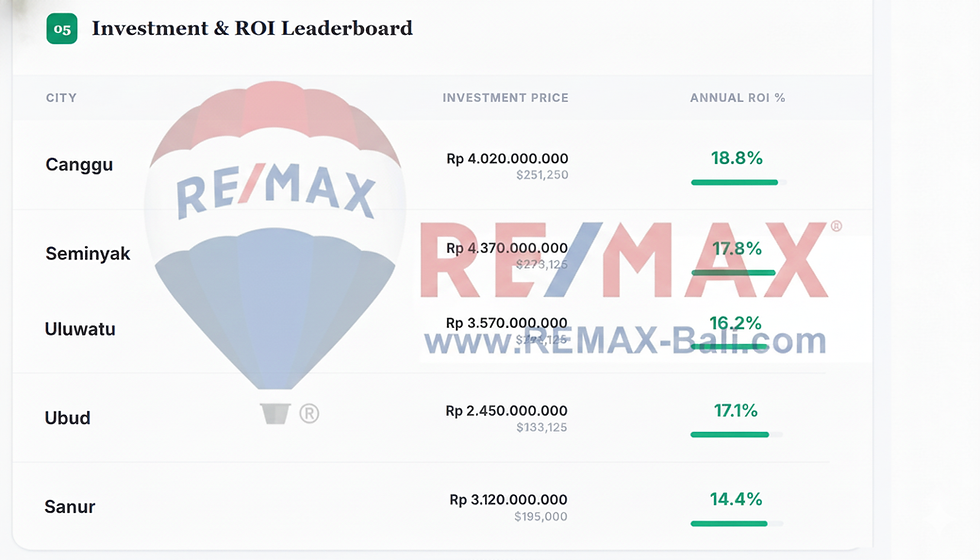

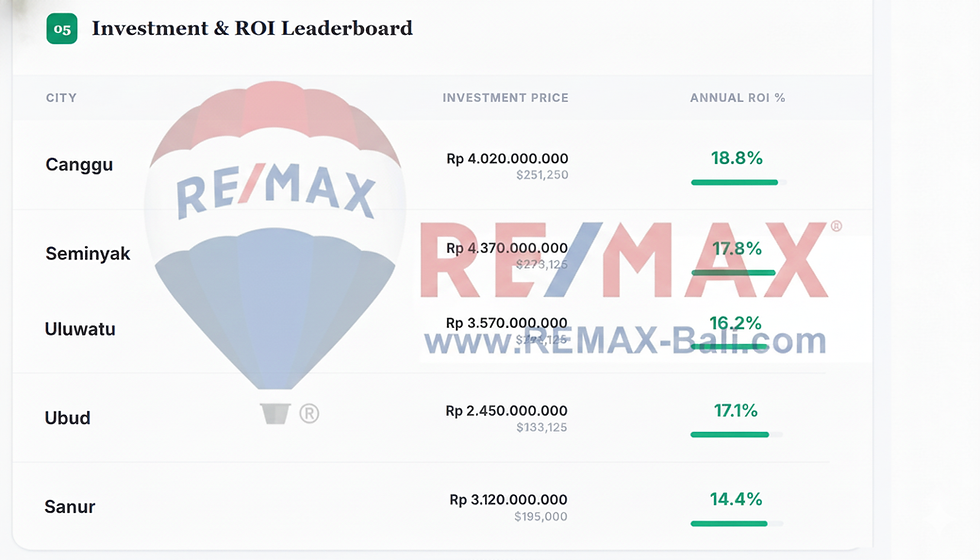

Comparative ROI Table (2026 Projections)

Based on a 150 sqm 2-bedroom traditional villa on 3 Are of land.

Summary of Findings

Lowest Entry Point: Ubud offers the most efficient capital use. You can complete a luxury villa for IDR 2.45 Billion ($153k), yielding a strong 17.1%.

Highest Cash Flow: Canggu generates the highest absolute profit (IDR 750M+ per year) but requires significantly higher upfront capital due to land lease costs.

Building Efficiency: Traditional construction (IDR 12M/sqm) remains the market standard for resale value

Long-Term Strategy: In 2026, properties that rank high in guest reviews and feature eco-conscious design will outperform pure location-based investments.

Comments